Business Income - A Lifeline for Your Business!

The Importance of Business Income Insurance: Safeguarding Your Business's Future

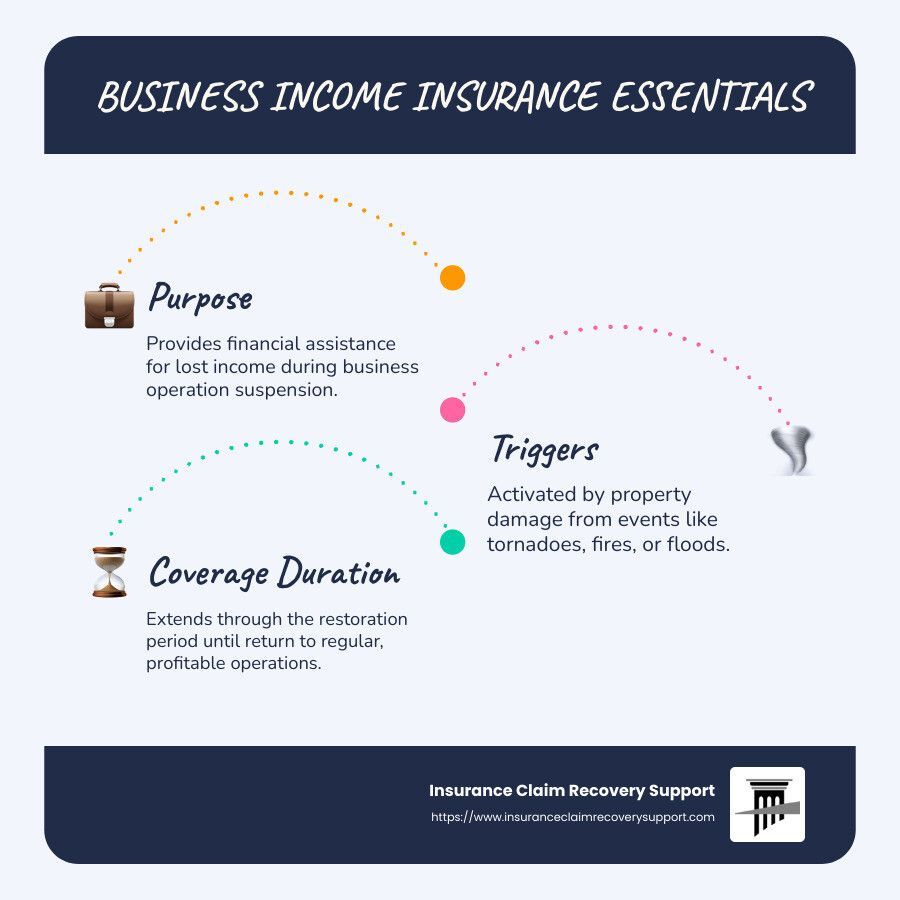

Today, we're going to talk about a vital, yet often overlooked, aspect of commercial insurance: Business Income Insurance. This coverage is crucial for protecting your revenue streams in case of unexpected disruptions. Let's dive in and demystify Business Income Insurance.

What is Business Income Insurance?

Business Income Insurance is designed to replace lost income when your business cannot operate due to a covered event, such as a fire, storm, or other disaster. This coverage ensures that you can continue to pay essential expenses like rent, payroll, and other operating costs, even when your business is temporarily out of commission. By having this safety net in place, businesses can focus on recovery without the added stress of financial instability. For more information, check out The Hartford's guide on Business Income Insurance.

Why is Business Income Insurance Important?

Imagine your business is hit by a major event that forces you to shut down for weeks or even months. Without Business Income Insurance, you might struggle to cover your ongoing expenses, which could lead to severe financial strain or even closure. This coverage ensures that your business can survive the downtime and get back on its feet. It is not just about covering losses; it's about ensuring continuity and stability in the face of adversity. Learn more about qualifying lost profits for business interruption claims from Meaden & Moore.

Key Components of Business Income Insurance

- Lost Income:

This includes the net income you would have earned if the loss hadn't occurred. It's crucial for maintaining financial stability during periods of inactivity.

- Operating Expenses:

These are the ongoing costs that you need to pay even when your business is not operating, like rent, utilities, and payroll. Covering these expenses helps prevent financial distress.

- Extra Expenses:

These are additional costs you might incur to minimize the downtime, such as renting temporary space or equipment. This component allows businesses to adapt quickly and efficiently to unforeseen circumstances.

How Does Business Income Insurance Work?

Business Income Insurance typically has a waiting period before the coverage kicks in. This period is usually around 72 hours, so it's not immediate. Understanding this timeframe is essential for planning and managing cash flow during the initial stages of a disruption. Unlike many other types of insurance, Business Income Insurance usually does not have a deductible, which can be a significant advantage for businesses looking to minimize out-of-pocket expenses.

Pro Tip: Extended Coverage

Here's a pro tip that many business owners don't know: Make sure your Business Income Insurance includes coverage for extended periods of interruption. Sometimes the impact of a disaster lasts longer than the immediate recovery period, and having this extended coverage can be a lifesaver. It provides additional peace of mind, knowing that your business is protected even during prolonged recovery phases. For further insights, visit Insurance Claim Recovery Support.

Ensuring Resilience with Business Income Insurance

Business Income Insurance isn't just about covering your losses—it's about ensuring your business can bounce back stronger and more resilient. At Thrive Insurance Group, we're here to help you understand and secure the coverage you need to protect your revenue streams and your business's future. Our goal is to equip you with the tools and knowledge necessary to navigate challenges and maintain operational continuity.

Conclusion

If you have any questions about Business Income Insurance or need expert advice on your commercial insurance needs, don't hesitate to reach out. Stay protected, stay resilient, and remember, at Thrive Insurance Group, we're committed to helping you thrive today and protect tomorrow.

Thrive Today, Protect Tomorrow!!!