Commercial Auto - What You Need to Know...

Understanding Auto Insurance: Tips and Tricks to Save Money

Today, I wanted to talk about some of the fundamentals of auto insurance, whether it's personal or commercial, and give you some tips and tricks on how to save money on your auto insurance.

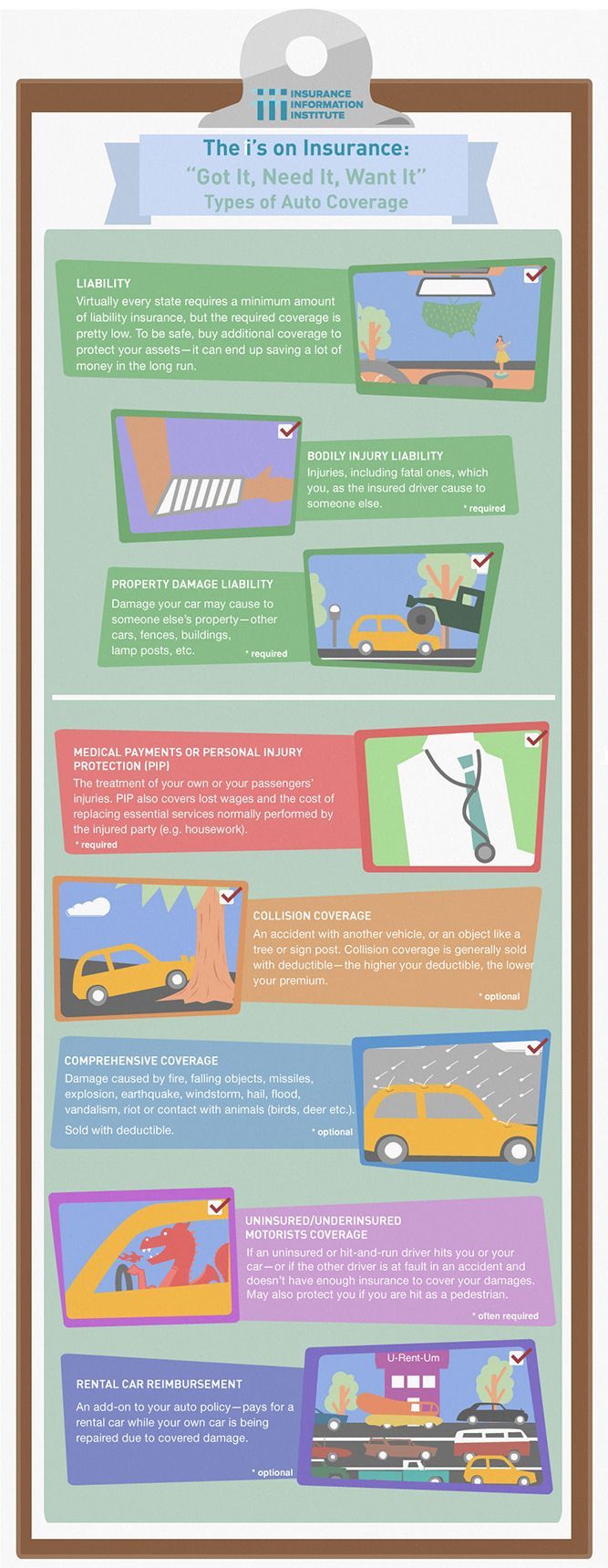

Liability Coverage

Let's start with liability coverage, which is a fundamental aspect of any auto insurance policy. For personal auto insurance, liability coverage can be structured as split limits or a combined single limit. Split limits are represented by numbers like 100/300/100, where the first number is the bodily injury coverage per person, the second is the bodily injury coverage per accident, and the third is property damage coverage.

It's crucial to ensure that your property damage coverage is sufficient to cover potential damages to someone else's vehicle. On the commercial side, liability coverage is often offered as a combined single limit, usually around $500,000 to $1 million, providing more flexibility by combining property and bodily injury coverage into one lump sum. Learn more about commercial auto insurance from Geico.

Importance of Understanding Limits

Understanding these limits is essential, as inadequate coverage can leave you financially vulnerable. It's important to assess your needs and choose the appropriate limits based on your risk exposure and financial situation. Consulting with an insurance professional can help tailor your coverage to fit your specific requirements.

Uninsured and Underinsured Motorist Coverages

Next, let's discuss uninsured and underinsured motorist coverage. This is an essential coverage to consider, especially since there are many drivers on the road without insurance. This coverage protects you in the event of an accident where the other party lacks sufficient insurance. It's generally affordable and provides peace of mind, particularly for commercial vehicles that may be more visible targets.

Benefits of Uninsured and Underinsured Motorists Coverages

Having uninsured and underinsured motorist coverage ensures that you are not left to bear the cost of damages and medical expenses if an uninsured driver hits you. This coverage can be a lifesaver in protecting your financial well-being and ensuring that you can recover without significant financial strain.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) is another important coverage that offers broader protection compared to basic medical payments coverage. PIP can cover medical expenses, lost wages, and other related costs in the event of an accident. It's recommended to opt for PIP if possible, as the cost difference is often minimal compared to the additional benefits it provides.

Advantages of PIP Coverage

PIP coverage ensures that you and your passengers have access to necessary medical care following an accident, covering a range of expenses that might otherwise be out-of-pocket.

Comprehensive and Collision Coverage

Comprehensive and collision coverage are designed to protect your vehicle. Collision coverage applies when you're involved in an accident with another vehicle or object, while comprehensive coverage protects against non-collision-related incidents like vandalism or natural disasters. Having both types of coverage ensures that your vehicle is protected in a wide range of scenarios

Evaluating Comp and Collision

These coverages are crucial for maintaining the value of your vehicle and preventing financial loss due to unforeseen events. Evaluating the cost of these coverages against the value of your vehicle can help determine the level of protection needed.

A Couple of "Pro Tips"

To maximize savings on your auto insurance, consider having a separate cargo insurance policy for commercial trucking risks. This way, any cargo-related claims won't affect your auto insurance rates.

Additionally, for roadside assistance, opt for third-party coverage. This prevents any roadside assistance claims from impacting your auto insurance premiums. Discover how to save on commercial auto insurance with Progressive.

Regular Policy Review is a Key Component of Success

Regularly reviewing your policy with your local broker or insurance agent ensures that you have the proper coverage in place to protect your business and personal assets. By staying informed and proactive, you can make sure you're getting the best value from your insurance policy. Comparing rates and taking advantage of discounts for safe driving or bundling policies can also lead to significant savings. Explore more ways to lower your commercial auto premiums.

Thank you for stopping by and reading this post. Should you have any further questions or if we can be of further assistance, please reach out to us and we would be glad to help out.

Thrive Today, Protect Tomorrow!