Navigating the Claims Process - How to Guide!

Navigating the Claims Process: Essential Tips for Small Business Owners

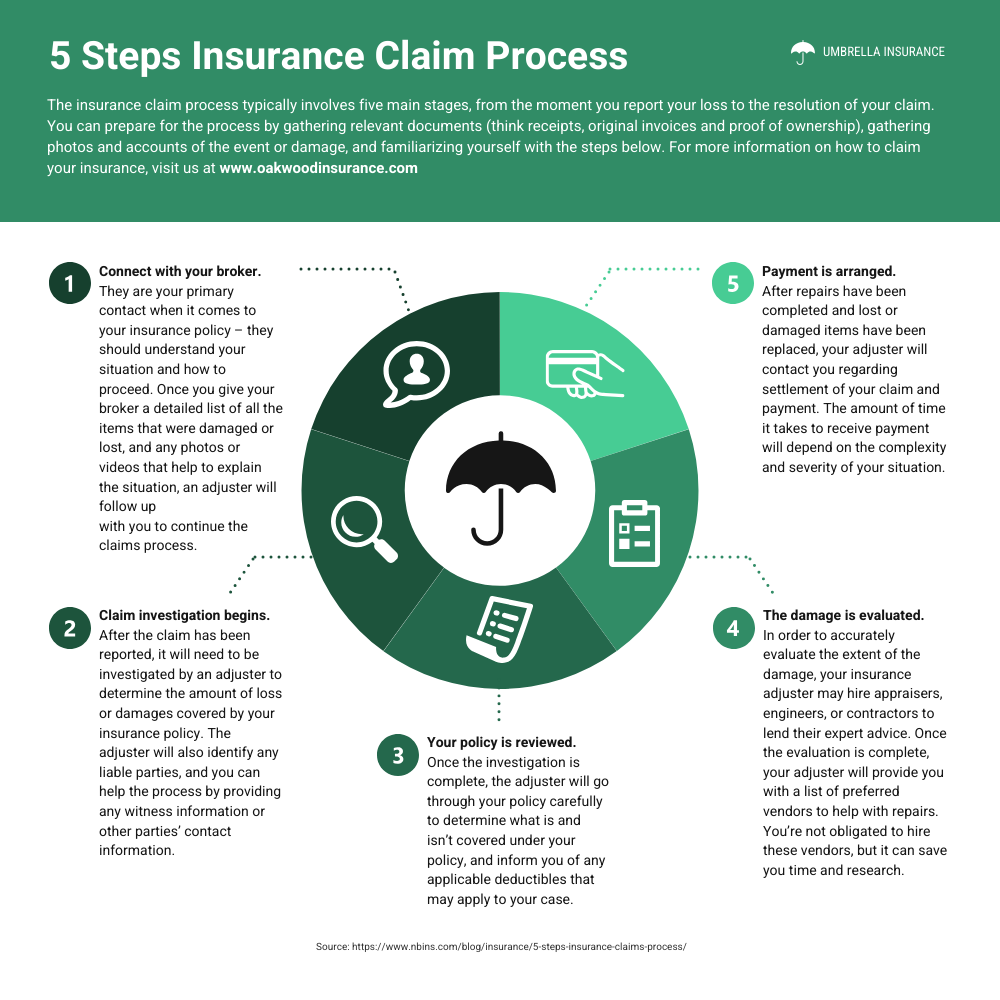

Today, we're diving into a crucial topic for small business owners: navigating the claims process. Filing an insurance claim can seem daunting, but with the right approach and information, it doesn't have to be. Let's explore the essential steps and information you'll need to ensure a smooth process.

Assessing Whether to File a Claim

Before diving into the claims process, it's important to assess whether filing a claim is the right decision. Conduct an impact analysis to determine if the claim might negatively affect your premiums. For instance, filing a $1,000 claim might not be worth the potential increase in insurance costs. Consult with your local agent to evaluate the situation and make an informed decision.

This proactive approach ensures that you only file claims that are truly beneficial for your business. For more insights, check out Travelers' guide on helping small business customers through the claim process.

Documentation is Key

From the moment an incident occurs, document everything related to it. Keep detailed records, including photos, videos, and written accounts. Make sure to note the date, time, and location of the incident. If applicable, obtain copies of any police reports or official documentation.

These will be invaluable when filing your claim, as they provide concrete evidence to support your case. Comprehensive documentation can significantly strengthen your claim and speed up the process. For a detailed guide on reporting claims, visit NAIC's insights on recovering and rebuilding.

Understand Your Policy

Have your insurance policy number and the contact details of your insurance company ready. Knowing the specifics of your coverage will help you set realistic expectations and avoid surprises during the claims process. Your policy documents contain crucial information about what is covered and any exclusions that may apply. If you're unsure, sit down with your insurance agent to go through the process and clarify any doubts. Understanding your policy thoroughly can prevent misunderstandings and delays.

Effective Communications

Maintain effective communication with your insurer. You'll likely interact with both a field adjuster, who conducts inspections, and a desk adjuster, who handles processing and operations. Communicate with them in the manner they prefer—if they call, return the call; if they email, reply via email.

This ensures clear and efficient communication. Always include your claim number in the subject line of emails to ensure your correspondence is properly tracked. Keeping a detailed record of all communications can help resolve any disputes or misunderstandings.

Collect Witness Information and Estimate the Loss

If there were any witnesses to the incident, gather their contact details and any statements they can provide. This can be crucial in supporting your claim. Additionally, prepare an estimate of the financial loss or damage incurred, including quotes or estimates for repairs or replacements. This will assist your insurer in assessing the claim and expedite the process. Providing a clear and detailed estimate can facilitate a quicker resolution. For more steps on filing a claim, refer to the U.S. Chamber of Commerce's guide.

Proof of Ownership/Documentation

Ensure you have documentation proving ownership of any damaged or lost items, such as receipts or purchase agreements. This is crucial for verifying your claim and demonstrating that the items in question are indeed yours. Proof of ownership can prevent disputes and ensure that your claim is processed smoothly.

Utilize Online Portals

Many insurance companies now offer online portals where you can file claims, upload documents, and track the progress of your claim. These portals often provide immediate access to your claim number and adjuster information, allowing you to jumpstart the process. Consider using these tools for a more streamlined experience. Online portals can also provide updates and notifications, keeping you informed throughout the process.

Regularly Review Your Policies...

New Paragraph