Workers Comp - Key Insights to Protect Your Business

Lower Your Workers Comp Premiums NOW with These Proven Strategies

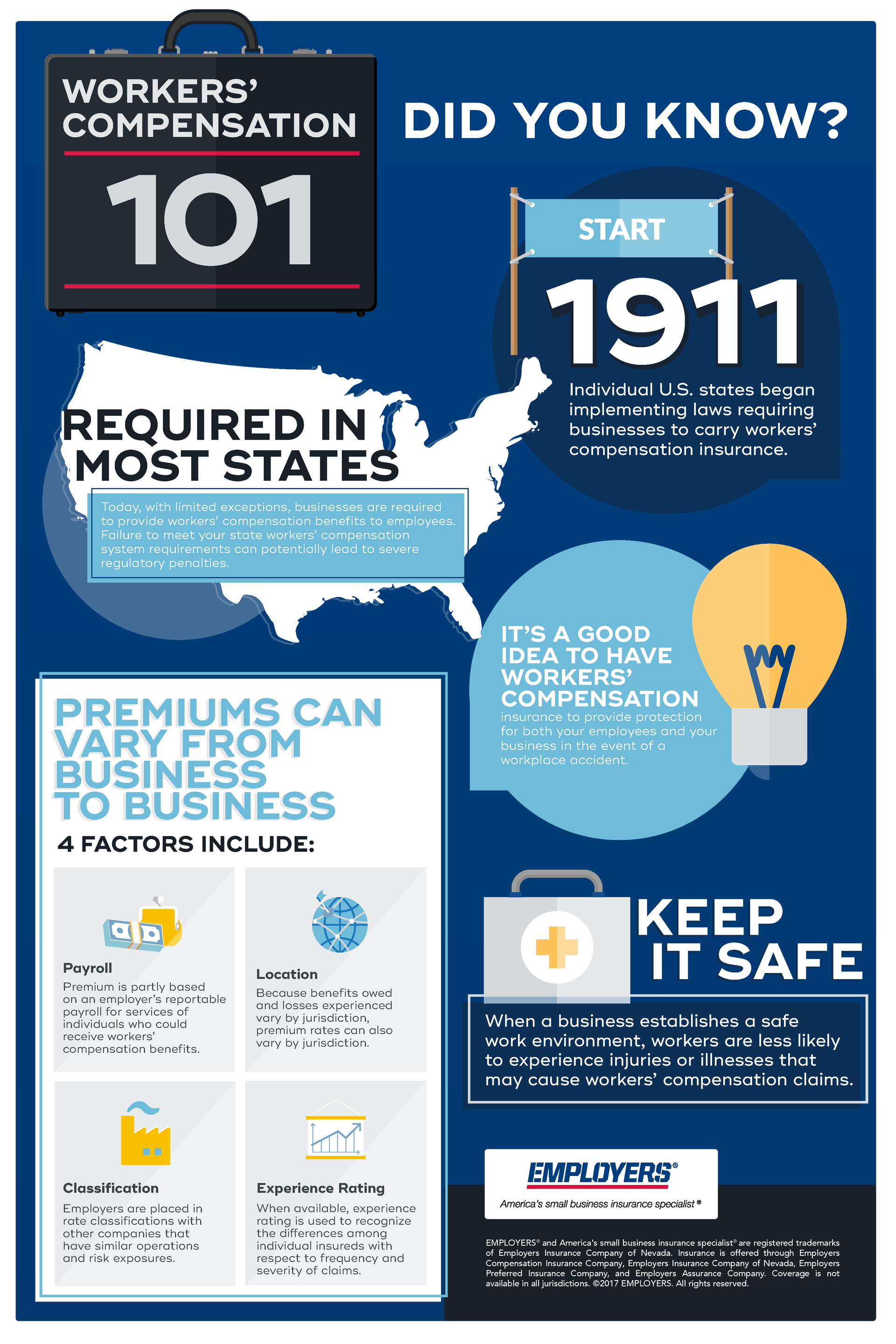

We are diving into the crucial role of workers' compensation insurance for your business and exploring effective strategies to manage your premiums.

Why Your Business Needs Workers' Compensation Insurance

Why Your Business Needs Workers' Compensation Insurance

1. Financial Protection: Workers' compensation insurance acts as a financial safety net, covering medical expenses and lost wages if an employee is injured on the job. The Mo-Vac Service Company case from 2018 is a prime example of the consequences of not having coverage, resulting in a $1.9 million judgment. This highlights the significant financial risks your business can face without insurance.

2. Legal Safeguards: While workers' compensation isn't mandatory everywhere, opting in provides legal protections. It limits your liability in workplace injury lawsuits, shielding you from potential legal battles and settlements that could be financially devastating.

3. Employee Well-being and Morale: Offering workers' compensation insurance demonstrates your commitment to employee safety and well-being. This can enhance morale, reduce turnover, and help you attract top talent, as employees feel secure knowing they're protected.

Three Hacks to Reduce Workers' Compensation Premiums

Employment practices issues are on the rise, with a 12% annual increase in claims over the past five years. This trend is driven by evolving workplace dynamics, including remote work, diverse workforce environments, and the increasing complexity of employment laws. As these dynamics change, so do the challenges businesses face, making EPLI more critical than ever. EPLI not only covers settlements and judgments but also the legal defense costs, which can be substantial even for unfounded claims. This financial protection allows businesses to focus on their operations without the burden of unexpected legal expenses.

The modern workplace is characterized by its diversity and the rapid evolution of employment practices. With more employees working remotely and the lines between work and personal life blurring, the potential for employment-related disputes has increased. Businesses must adapt to these changes by ensuring they have the right protections in place, and EPLI is a key part of this strategy.

Three Hacks to Reduce Workers' Compensation Premiums

- Implement a Safety Program: A comprehensive workplace safety program can significantly lower the risk of accidents. Regular training and safe practices not only protect your employees but can also lead to premium discounts from insurers who recognize your commitment to safety.

- Use Return-to-Work Programs: These programs facilitate the transition of injured employees back to work, reducing indemnity costs. By demonstrating effective claims management, you can potentially lower your premiums.

- Shop Around and Bundle Policies: Don’t settle for the first quote. Compare rates from different insurers and consider bundling your workers' comp with other business insurance policies to receive multi-policy discounts. Learn more about the benefits of workers' compensation for small businesses in this article from Minnesota Chamber of Commerce.

Understanding the Experience Modification Factor (e-Mod)

If your annual premium reaches around $9,500, you may qualify for an experience modification factor. This mod adjusts your premium based on your claims history relative to industry standards. A lower mod, indicating fewer claims, can lead to significant premium reductions. This system incentivizes maintaining a safe work environment and effectively managing claims.

Final Thoughts...

Workers' compensation is a cornerstone of your small business's risk management strategy. While not mandatory in some places, it’s crucial for financial protection and legal compliance, especially in contractual obligations with franchises or city contracts. The coverage is generally based on payroll, safety scores, and return-to-work programs, allowing you to control many premium costs. For more detailed information, check out this guide on workers' comp insurance for small businesses from The Hartford.

Insurance companies are currently eager to attract workers' comp policies, making it a good time to shop around. Working with your local insurance agent can help you explore competitive options and ensure your policies are up-to-date.

Additionally, understanding and managing your modifier score is essential. If your score is above average, there are ways to reduce it to align closer to industry standards, benefiting your renewal perspective.

In conclusion, while workers' compensation insurance isn't mandatory everywhere, it's a wise investment for your business's financial health and employee safety.

By implementing safety measures and exploring cost-saving strategies, you can protect your business and manage expenses effectively.

If you have any questions or need further assistance, feel free to reach out to us at Thrive Insurance Group. Remember, "Thrive Today, Protect Tomorrow." Thanks for reading, and have a great day!