If Your Insurance Costs Are Rising, Then Read This Blog to Keep Them in Check

Why Are Commercial Insurance Rates Rising...

In recent years, businesses across various sectors have been grappling with the rising costs of commercial insurance. This increase is driven by a combination of factors that affect insurers and policyholders alike. Understanding these elements can help businesses better manage their insurance expenses and explore strategies to mitigate these rising costs. In this post, we will discuss the various factors driving these increases and offer some ways to help drive these costs out of your organization.

Increased Component Costs

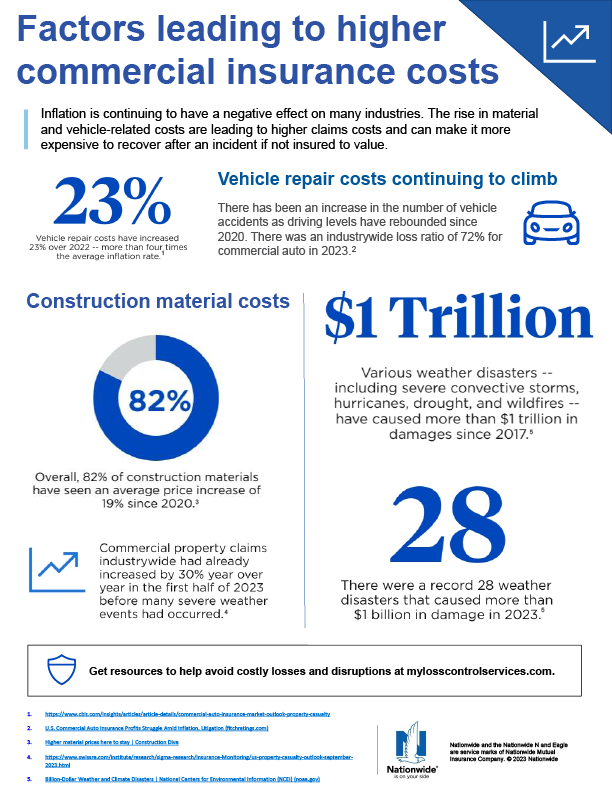

One of the significant contributors to higher insurance premiums is the rising cost of components and repairs. Lets look at the component costs of vehicle repairs for example. Modern commercial vehicles are equipped with advanced technology, making repairs more expensive. For instance, replacing a windshield on a new truck can cost thousands due to integrated GPS systems and sensors. These increased repair costs lead insurers to raise premiums to cover potential claims. Additionally, global supply chain disruptions have exacerbated these costs, leading to delays and further price hikes for parts and labor.

Impact of Natural Disasters

Natural disasters have become more frequent and severe, particularly in regions prone to hurricanes, floods, and wildfires. These events result in substantial claims, forcing insurers to adjust their pricing models to account for the increased risk. The financial burden of these disasters is shared by policyholders through higher premiums. According to the Swiss Re Institute, global insured losses from natural catastrophes reached USD 60 billion in the first half of 2024, highlighting the impact of these events on insurance costs.

Inflation and Economic Pressures

The current inflationary environment affects all sectors, including insurance. Rising costs of goods and services increase operational expenses for insurers, which are then passed on to consumers in the form of higher premiums. Inflation impacts everything from repair costs to administrative expenses, contributing to the overall increase in insurance pricing. Businesses are also facing increased operational costs, such as higher wages and utilities, which add to the financial pressures and necessitate a reevaluation of their insurance strategies.

Legal and Regulatory Changes

Recent years have seen a rise in "nuclear verdicts," where courts award damages in the millions. These large jury awards significantly impact insurers, who must cover these costs. The defense expenses associated with these verdicts are substantial, further straining the resources of insurance companies and leading to increased premiums. For more insights into how these verdicts impact the insurance landscape, you can explore analyses from industry experts and legal reform organizations. Additionally, the Insurance Journal discusses how these factors are influencing the global insurance market in their article here.

Strategies to Manage and Reduce Insurance Costs

- Risk Management: Implement comprehensive risk management practices to reduce the likelihood of claims. This includes regular maintenance of equipment, employee training, and safety protocols. Proactively identifying and mitigating risks can lead to lower premiums and fewer claims.

- Invest in Technology: Utilize technology to monitor and manage risks effectively. Telematics, for example, can provide valuable data on vehicle usage, helping to reduce claims and potentially lower premiums. Implementing cybersecurity measures can also protect against data breaches, reducing potential liabilities.

- Employee Training Programs: Invest in training programs that focus on safety and risk management. Well-trained employees are less likely to cause accidents, which can lead to fewer claims and lower premiums.

- Review and Optimize Coverage: Regularly review your insurance policies to ensure they align with your current business needs. Adjusting coverage limits and deductibles can help manage costs without sacrificing essential protection.

- Leverage Data Analytics: Use data analytics to identify trends and areas where risk can be minimized. This insight can help tailor insurance coverage to better fit your business's unique risk profile, potentially reducing premiums.

Conclusion

The rising costs of commercial insurance are driven by a complex interplay of factors, from increased repair costs to natural disasters and legal changes. By understanding these elements and implementing proactive strategies, businesses can better manage their insurance expenses and drive these costs out of their organization.

For further information and assistance, contact Thrive Insurance Group. Remember, taking proactive steps today can help protect your business tomorrow.