Small Business Cyber Threat Survival Guide

Protecting Your Business from Cyber Threats: A Guide for Small Businesses

In the digital age, small businesses are increasingly at risk from cyber threats, making cyber liability insurance a crucial component of any risk management strategy. Understanding these threats and how to mitigate them is essential for protecting your business.

Why Cyber Liability Matters for All Businesses

Cyber liability is critical for businesses across all industries. As cyber threats become more sophisticated, businesses of all sizes face growing risks. Handling sensitive data such as private, credit card, or customer information necessitates an additional layer of protection. A single data breach can result in significant financial loss, legal challenges, and reputational damage. Cyber liability policies clearly outline what's covered and excluded, empowering you to proactively safeguard your business, minimize risks, and ensure continuity during cyber incidents.

Understanding Cyber Threats

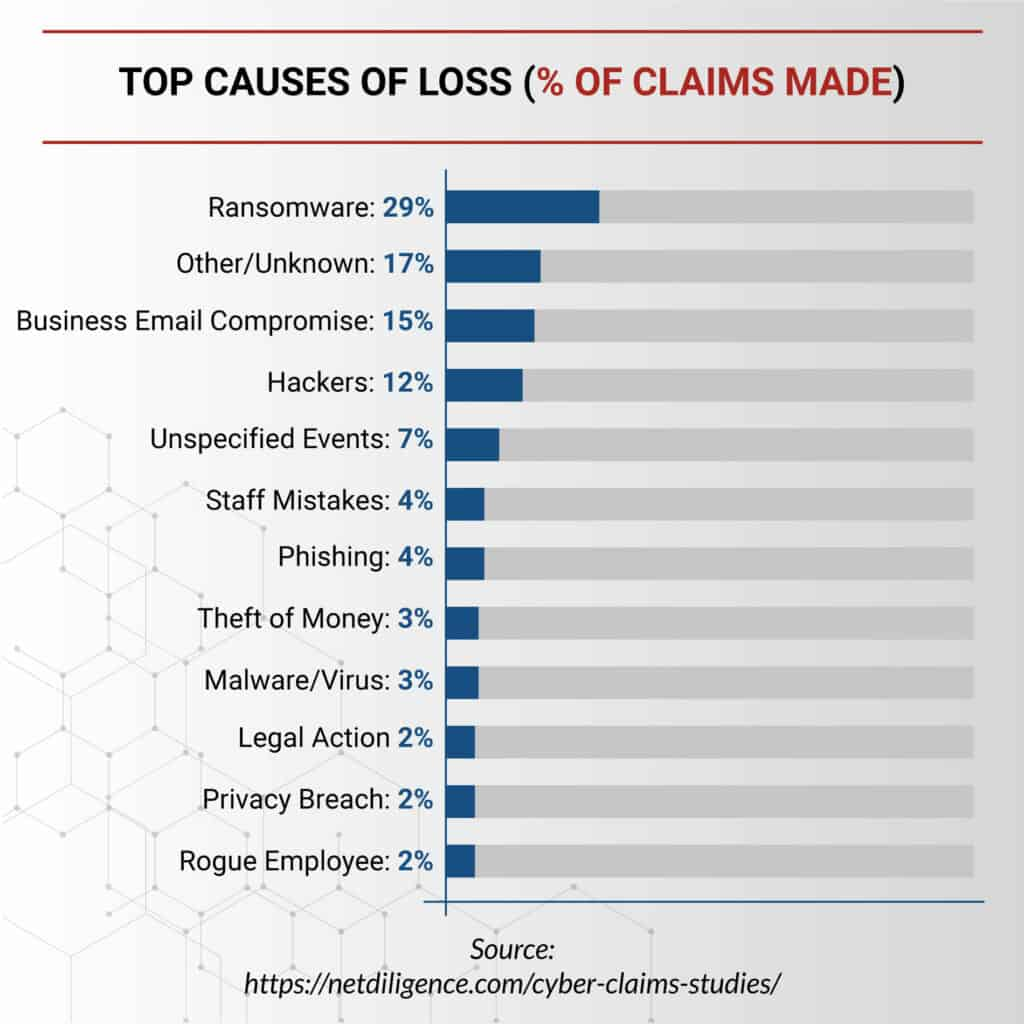

Cyber threats are rapidly evolving and can emerge from various sources, impacting businesses in numerous ways. For instance, in 2023, 41% of small businesses reported experiencing a cyber attack, up from 38% in 2022 (Link to article). Small businesses account for 43% of cyber attacks annually, highlighting their vulnerability (Link to article). Ransomware attacks pose significant operational risks and are among the most common threats to small businesses (Link to article). Being proactive in your defense strategy is essential. Collaborating with a local agent and a systems integration or cyber firm ensures comprehensive protection. A holistic approach, combining cyber liability with IT integration, is key to safeguarding your business.

Partnering for Protection

Collaborating with partners who understand both liability and IT aspects is vital. Many small businesses overlook the importance of connecting these dots. At Thrive Insurance Group, we emphasize the significance of integrating cyber liability with IT solutions to protect our clients effectively.

Key Areas of Cyber Liability Coverage

Understanding what a cyber liability policy covers is essential. Here are the top five areas typically included:

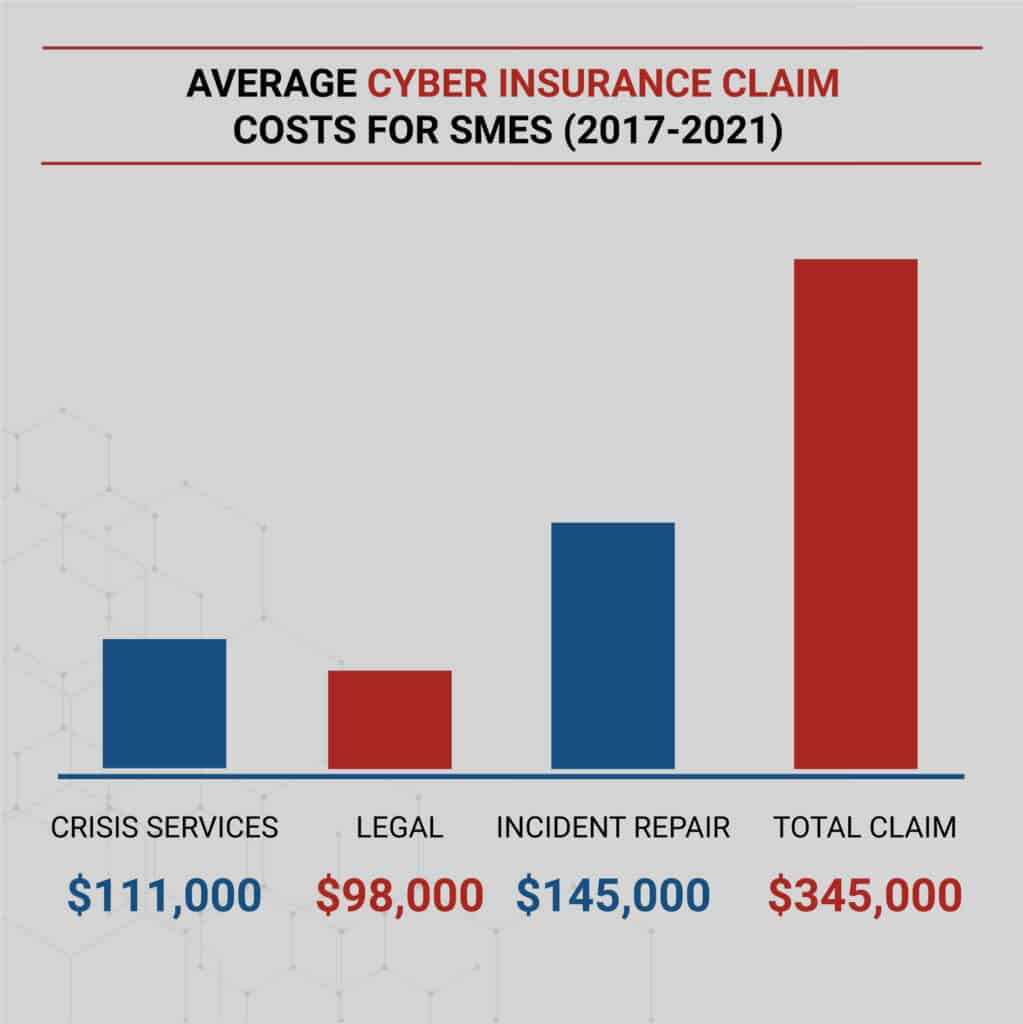

- Data Recovery: Provides assistance in retrieving and restoring lost or compromised data, ensuring your business can quickly resume normal operations after a cyber incident.

- Legal Expenses: Covers the legal costs associated with a cyber incident, such as defending against lawsuits, paying compliance fines, and handling penalties.

- Reputational Damage: Offers support to manage and mitigate the impact on your business's reputation, including public relations efforts and communication strategies to maintain trust with clients and stakeholders.

- Incident Response: Grants access to a specialized team that provides immediate action and expertise to manage and mitigate cyber incidents, minimizing damage and disruption to your business.

- Business Income Coverage: Compensates for lost income if your business operations are interrupted due to a cyber incident, helping to maintain financial stability during the recovery period.

It's crucial to review the exclusions in your policy. Work with your local agent to ensure these exclusions are addressed, particularly regarding business income coverage. Understanding what's included and excluded in your policy is critical for comprehensive protection.

Tailored Solutions for Your Industry

Each industry faces unique challenges and requirements regarding cyber protection. Tailoring your cyber liability strategy to align with your specific industry needs is essential. Understanding the particular risks and regulatory requirements your business faces ensures that your cyber defenses are robust and effective. This tailored approach helps protect your business's unique assets and operations.

Reach Out for Support

If you have questions about cyber liability or need assistance in protecting your business, please reach out to us. We're here to have a conversation about cyber liability and ensure you're working to incorporate these protections into your resiliency plan. In today's unpredictable world, safeguarding our small & medium businesses—the foundation of our economy—is more important than ever.