Unlocking the Secrets to Commercial Insurance Pricing: What Every Business Owner Needs to Know

In the world of business, understanding the intricacies of commercial insurance pricing can be your secret weapon.

At Thrive Insurance Group, we're all about empowering you with the knowledge to make savvy decisions that not only protect your business but also save you money. Let’s dive into the key factors that influence your insurance premiums and how you can leverage them to your advantage.

1. Classification Codes: The Blueprint of Your Premiums

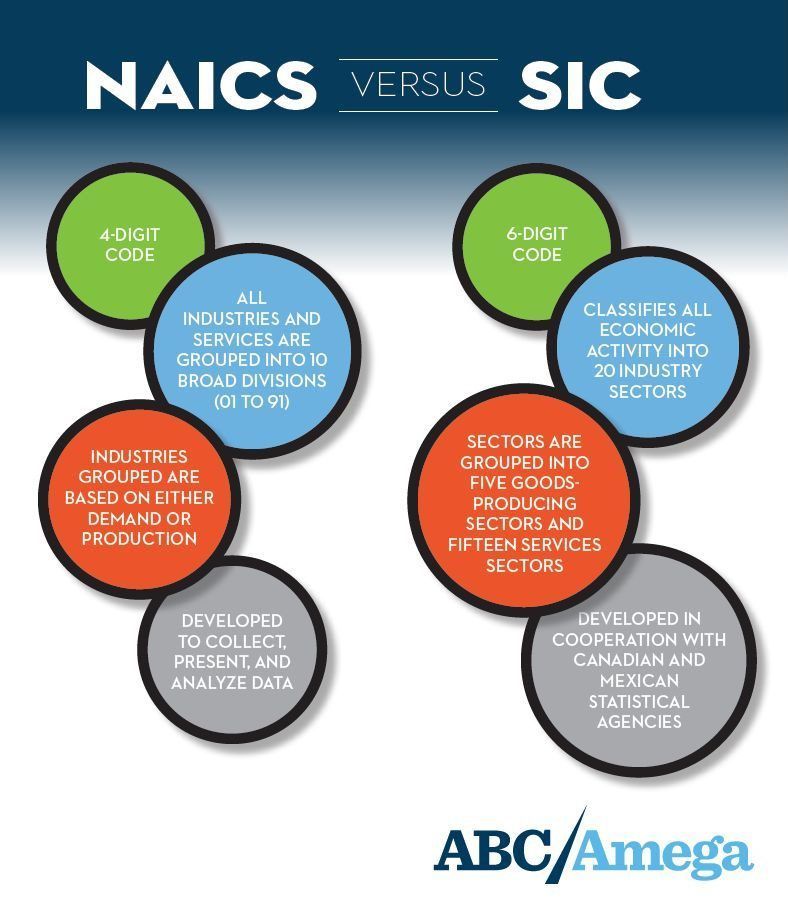

Think of classification codes as the DNA of your insurance policy. These codes, rooted in NAICS and SIC classifications, are essential in defining the unique risks associated with your industry. Whether you're a cutting-edge tech startup or a robust construction firm, these codes help insurers assess risk and set your premiums. Ensuring accurate classification is your first step in avoiding unnecessary costs and securing the best rates. It's like having the right map for your business journey—precision here leads to smoother sailing.

2. Credit Scores: The Silent Influencer

Your business credit score is more than just a number—it's a testament to your financial health. Insurers use this score to evaluate your business's stability. A strong credit score can be your ticket to lower premiums, signaling to insurers that you're a low-risk investment. Keep your credit score in top shape by managing debts wisely and paying bills promptly. Consider it your financial report card; a good grade can open doors to better insurance deals.

3. Claims History: Your Past Shapes Your Future

Your claims history is like a crystal ball for insurers, predicting future risks based on past behavior. A spotless claims record can be your best ally in securing favorable rates. Implementing effective risk management strategies and maintaining a clean claims history not only keeps costs down but also builds trust with your insurer. Think of it as your reputation in the insurance world—maintain it well, and it can pay dividends.

4. Location, Location, Location

Where you do business matters—a lot. If you're in a high-risk area prone to natural disasters or crime, your premiums might reflect that. Insurers meticulously assess local risks when determining rates, so understanding how your location impacts your insurance is crucial for strategic planning. It's akin to real estate; location can be everything, influencing not just price but the very nature of your coverage needs.

5. Tailor Your Coverage: Protection Meets Affordability

Choosing the right coverage is a balancing act between comprehensive protection and cost. Higher coverage limits offer peace of mind but come at a premium. Tailor your policy to fit your specific needs, ensuring you're not overpaying for unnecessary coverage. This customization is your opportunity to align insurance with your business strategy, optimizing both protection and expenditure.

6. Safety First: The Key to Lower Premiums

Investing in safety measures is not just good practice—it's smart business. Businesses that prioritize safety with security systems, regular training, and robust protocols often enjoy lower premiums. These initiatives demonstrate to insurers your commitment to minimizing risks, translating to cost savings. It's about creating a culture of safety that not only protects your team but also your bottom line.

7. Business Operations: The Heartbeat of Your Premiums

The nature of your operations plays a pivotal role in your insurance costs. A delivery service with a fleet of vehicles, for example, faces different risks compared to a consulting firm. Understanding these nuances allows you to make informed decisions that can keep your premiums in check. Your business model and daily operations are like the engine of a car; they drive your insurance needs and costs.

8. Revenue and Payroll: Size Matters

Your business's size, reflected in revenue and payroll, is a significant factor in determining premiums. Larger businesses with more employees might face higher costs due to increased exposure. Accurate reporting is essential to avoid audits and ensure fair pricing. It's a straightforward equation: more employees and higher revenue often mean more risk and, consequently, higher insurance requirements.

9. Equipment and Property: Valuation is Key

High-value equipment and property demand more coverage, impacting your premiums. Regularly assess and update your coverage to align with the current value of your assets, ensuring you're adequately protected without overpaying. Think of this as asset management within your insurance strategy—protecting what’s valuable without unnecessary expense.

10. Deductibles and Policy Limits: Finding the Sweet Spot

Opting for higher deductibles can reduce your premiums but increases your financial responsibility in a claim. Conversely, higher policy limits provide more coverage but come at a cost. Strike a balance that aligns with your financial strategy and risk tolerance. This decision is akin to choosing the right gear for a journey—it's about balancing cost efficiency with preparedness.

11. Additional Factors: The Full Picture

Consider employee factors, industry experience, regulatory compliance, and market conditions—all of which influence your premiums. Loss control programs and insurer-specific guidelines also play a role in shaping costs. These elements are like the fine print in a contract; they complete the picture and ensure you're fully informed

Your Path to Smarter Insurance Decisions

Understanding the myriad factors influencing commercial insurance pricing is your gateway to smarter, more cost-effective decisions. It’s crucial to work closely with a local insurance broker or agent who understands your unique needs and risk profile. They can help map these to a comprehensive risk management strategy, ensuring your insurance strategy is perfectly aligned with your business goals.

For further reading and general insurance insights, the Insurance Information Institute offers a wealth of information.